The Complete Guide to 13 PM Interview Question Types (And How to Answer Each)

Master every type of PM interview question from Feature Design to Ethical Dilemmas. Learn which questions appear most often and how to structure winning answers for each.

Walk into any FAANG PM interview and you'll face one of 13 distinct question types. Each type tests different skills, requires different frameworks, and has unique evaluation criteria.

Most candidates prepare for "product design questions" generically. That's a mistake. A Feature Design question requires a completely different approach than a New Product (0→1) question — even though both seem like "design" questions.

This guide breaks down all 13 types, ranked by frequency, with example questions and the exact structure interviewers expect for each.

Disclaimer: Interview formats and question types evolve continuously as companies refine their hiring processes. The frameworks and approaches described here are based on historical interview patterns and publicly available information. This guide is intended for educational purposes only to help you develop structured thinking skills. Always research the most current interview format for your target company and role.

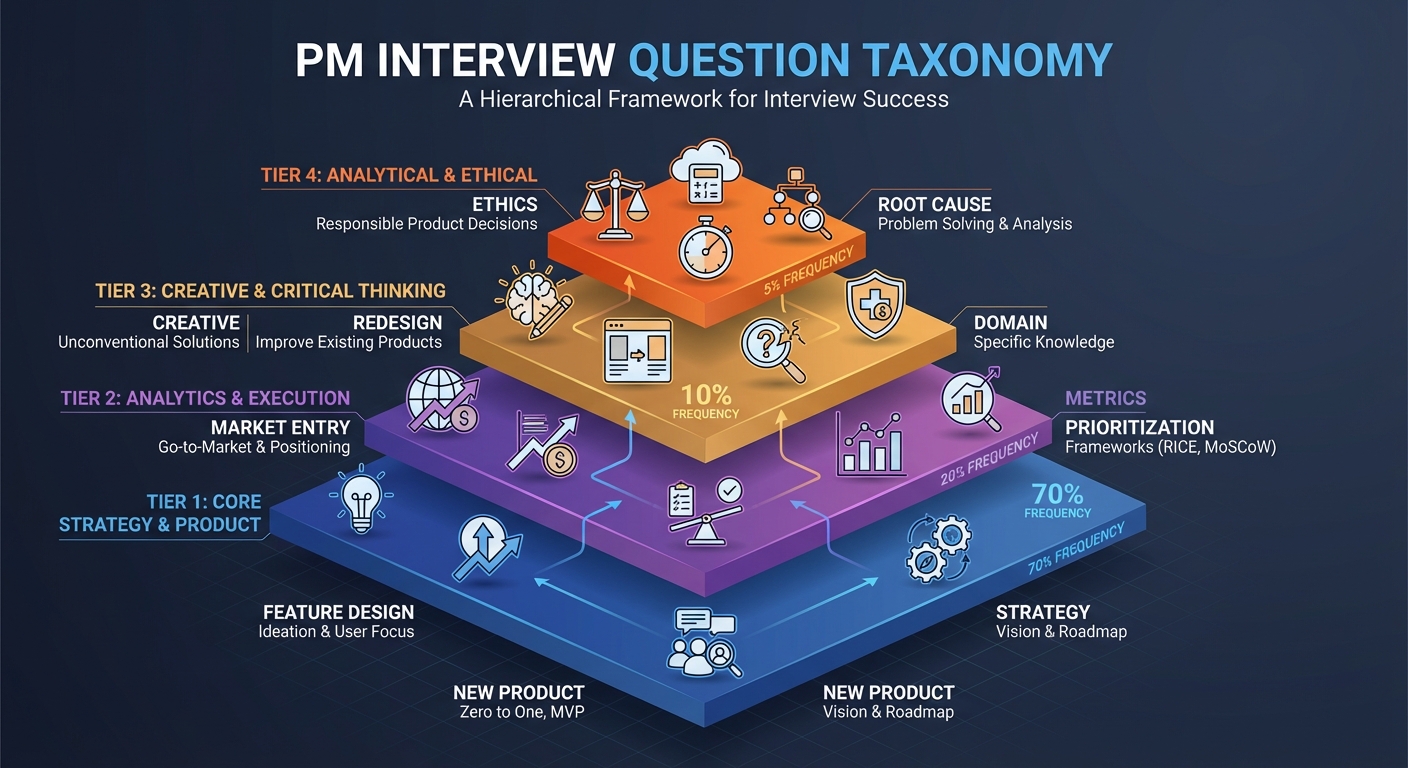

The 13 Question Types (By Frequency)

After analyzing thousands of PM interviews, here's the complete taxonomy:

TIER 1: Core Design Questions (70% of interviews)

These three types make up the majority of PM interviews. Master these first.

- Type 1: Feature Design / Improvement (40%)

- Type 2: New Product (0→1) (20%)

- Type 3: Product Strategy/Vision (10%)

TIER 2: Strategic/Business Questions (20% of interviews)

These test business judgment and analytical thinking.

- Type 4: Market Entry / Build-vs-Buy (8%)

- Type 5: Prioritization / Tradeoffs (7%)

- Type 6: Product Metrics / Diagnosis (5%)

TIER 3: Specialized/Creative Questions (10% of interviews)

These test creativity and domain expertise.

- Type 7: Creative/Hypothetical (4%)

- Type 8: Redesign / Reimagine (3%)

- Type 9: Favorite Product / Critique (2%)

- Type 10: Domain-Specific (1%)

TIER 4: Rare/Edge Cases (5% of interviews)

Less common but still important to prepare for.

- Type 11: Ethical Dilemmas (2%)

- Type 12: Estimation / Sizing (2%)

- Type 13: Root Cause Analysis (1%)

TIER 1: Core Design Questions

Type 1: Feature Design / Improvement (40% of interviews)

What it tests: Product intuition, user empathy, execution ability

Key characteristic: You're improving an existing product or feature, not building from scratch.

Example questions:

- "How would you improve Instagram Stories?"

- "How would you increase engagement on Google Maps?"

- "Fix Spotify's shuffle algorithm"

- "Improve Uber's driver matching system"

Critical structure:

- DO NOT start with clarifying questions (waste of time for existing products)

- Jump straight into problem identification

- Propose 2-3 targeted solutions

- Prioritize based on impact vs effort

Common mistake: Treating this like a Type 2 (New Product) and asking "what's the goal?" The goal is obvious: improve the feature. Skip to insights.

Company-specific note: Meta interviews are heavily Type 1-focused. Learn Meta's unique approach to feature improvement in our dedicated guide: How to Answer Meta PM Interview Questions.

Zobhe example:

Try: "How would you improve Netflix recommendations?" on Zobhe to see a Type 1 answer structure.

Type 2: New Product (0→1) (20% of interviews)

What it tests: Strategic thinking, market analysis, 0→1 vision

Key characteristic: Building a brand new product from scratch.

Example questions:

- "Design a product for busy professionals struggling with work-life balance"

- "Build a new product for Meta to enter professional networking"

- "Create a product to help freelancers manage finances"

- "Design a 0→1 product for remote workers"

Critical structure (MUST follow this):

- Clarifying questions (5 mins): Goal, target users, constraints

- Market opportunity (TAM/SAM/SOM analysis)

- User personas (specific, data-driven)

- Solution ideation (multiple concepts)

- Prioritization (pick ONE to detail)

- Success metrics (leading + lagging indicators)

Common mistake: Skipping TAM/SAM/SOM. Interviewers expect you to size the market for 0→1 products.

Key difference from Type 1:

- Type 1 = Improve existing feature (no clarifying questions needed)

- Type 2 = New product (MUST ask clarifying questions + market sizing)

Type 3: Product Strategy/Vision (10% of interviews)

What it tests: Long-term thinking, competitive analysis, strategic vision

Key characteristic: 3-5 year strategic direction, not tactical features.

Example questions:

- "What should be Meta's product strategy for the next 5 years?"

- "How should Netflix position itself against Disney+ over the next 3-5 years?"

- "What's your strategic vision for Google Search in an AI-first world?"

- "Where should Spotify focus for the next decade?"

Critical structure:

- Clarifying questions (understand current state + constraints)

- Market trends analysis (where is the world going?)

- Competitive positioning (how do we win?)

- Strategic pillars (3-5 key bets)

- Roadmap themes (not specific features, but directions)

- Success metrics (long-term KPIs)

Common mistake: Proposing specific features instead of strategic themes. This is a vision question, not a feature question.

Signal interviewers look for:

- Deep understanding of competitive landscape

- Ability to identify macro trends

- Strategic tradeoffs (what you WON'T do)

- Long-term thinking (not quarterly goals)

TIER 2: Strategic/Business Questions

Type 4: Market Entry / Build-vs-Buy (8% of interviews)

What it tests: Business judgment, strategic analysis, decision-making frameworks

Key characteristic: Evaluating whether to build, buy, or partner for a new capability.

Example questions:

- "Should Meta build, buy, or partner to enter professional networking?"

- "Should Google enter the social media market?"

- "Should Uber build, buy, or partner for grocery delivery?"

- "Should Netflix acquire a gaming studio or build in-house?"

Critical structure:

- Clarifying questions (strategic goals, timeline, budget)

- Option 1: Build

- Pros (control, culture fit, competitive advantage)

- Cons (time, cost, risk)

- Option 2: Buy

- Pros (speed to market, proven team, IP)

- Cons (integration risk, price, culture clash)

- Option 3: Partner

- Pros (low risk, fast, shared resources)

- Cons (less control, dependency, margins)

- Recommendation (pick ONE with clear rationale)

Common mistake: Only analyzing one option. You MUST compare all three.

Type 5: Prioritization / Tradeoffs (7% of interviews)

What it tests: Prioritization frameworks, resource allocation, decision-making under constraints

Key characteristic: Limited resources, must choose between competing options.

Example questions:

- "You have 3 features but only resources for 1. How do you prioritize?"

- "Prioritize these 5 features for the next quarter"

- "What tradeoffs would you make between speed and quality?"

- "How would you allocate resources between product A and B?"

Critical structure:

- Define criteria (impact, effort, strategic alignment, risk)

- Use framework (RICE, value/effort matrix, weighted scoring)

- Evaluate each option (score systematically)

- Make recommendation (with clear rationale)

- Acknowledge tradeoffs (what you're sacrificing)

Frameworks to know:

- RICE: Reach × Impact × Confidence / Effort

- Value vs Effort Matrix: 2×2 grid

- Kano Model: Must-haves vs delighters

- Weighted Scoring: Custom criteria with weights

Common mistake: Gut feel decisions without structured framework.

Type 6: Product Metrics / Diagnosis (5% of interviews)

What it tests: Analytical thinking, root cause analysis, metrics fluency

Key characteristic: A metric dropped. Figure out why.

Example questions:

- "DAU on Instagram dropped 10% last week. What happened?"

- "Engagement on YouTube decreased 15%. How do you diagnose this?"

- "Conversion rate fell from 5% to 3%. What would you do?"

- "Monthly active users dropped suddenly. Investigate why."

Critical structure:

- Clarify the metric (how measured? baseline? segment?)

- Hypothesize causes:

- External: Seasonality, competitor launch, macro events

- Internal: Product bug, experiment, feature change

- Data: Tracking issue, definition change

- Segment analysis (by user cohort, platform, geography)

- Investigation plan (what data to pull, in what order)

- Recommendations (short-term fixes + long-term prevention)

Common mistake: Jumping to solutions before understanding the problem.

Meta-specific note: Use Growth Accounting to decompose:

- Is it new user drop, resurrection drop, or churn spike?

- Learn more: How Meta Uses Growth Accounting in Interviews

TIER 3: Specialized/Creative Questions

Type 7: Creative/Hypothetical (4% of interviews)

What it tests: Creativity, thinking outside the box, innovation

Key characteristic: Unusual, imaginative scenarios that don't exist yet.

Example questions:

- "Design a social media product for pets — where pets are the primary users"

- "Design a product that would get teenagers excited about VR"

- "Imagine a creative way to revolutionize event discovery"

- "Design a metaverse feature for Gen Z"

Critical structure:

- Can skip formal clarifying questions (be creative!)

- Focus on novel user needs in the hypothetical scenario

- Embrace out-of-the-box thinking

- Still ground in user research (even hypothetically)

Common mistake: Being too conservative. This is your chance to be bold.

Signal interviewers look for:

- Original ideas

- Ability to think beyond current paradigms

- Still structured (not random brainstorming)

Type 8: Redesign / Reimagine (3% of interviews)

What it tests: Systems thinking, design intuition, ability to challenge status quo

Key characteristic: Complete redesign of an existing product from scratch.

Example questions:

- "Redesign the Facebook News Feed from scratch"

- "If you could rebuild Gmail from the ground up, how would you do it?"

- "Reimagine the LinkedIn profile page"

- "Redesign the Uber rider experience"

Critical structure:

- Analyze current state (what works, what doesn't)

- Identify core problems (not surface issues)

- Propose redesign (radical changes allowed)

- Justify changes (why this is better)

Common mistake: Minor tweaks instead of bold reimagining.

Type 9: Favorite Product / Critique (2% of interviews)

What it tests: Product taste, critical thinking, ability to articulate what makes products great

Key characteristic: Analyze a product you love or use daily.

Example questions:

- "What's your favorite product and why? How would you improve it?"

- "Critique the Notion app"

- "What product do you use daily? What would you change?"

- "Tell me about a product you love and one thing you'd fix"

Critical structure:

- Pick a product (ideally relevant to the company)

- Explain why you love it (specific features, UX, value prop)

- Identify weaknesses (balanced critique)

- Propose improvements (1-2 concrete ideas)

Common mistake: Picking a product unrelated to the company (shows lack of research).

Type 10: Domain-Specific (1% of interviews)

What it tests: Domain expertise (hardware, API, B2B, gaming, fintech, healthcare)

Key characteristic: Requires specialized knowledge of a specific domain.

Example questions:

- "Design a wearable device for elderly care" (Hardware)

- "Design a public API for developers" (API/Platform)

- "Design a B2B SaaS product for enterprise sales teams" (B2B)

- "Design a new game mode for Fortnite" (Gaming)

Critical structure:

- Use domain-specific frameworks (not generic PM frameworks)

- Show technical depth (hardware constraints, API design principles, B2B sales cycles)

- Acknowledge unique constraints (manufacturing, developer adoption, enterprise contracts)

Common mistake: Applying consumer product thinking to B2B/hardware/gaming.

TIER 4: Rare/Edge Cases

Type 11: Ethical Dilemmas (2% of interviews)

What it tests: Ethical reasoning, stakeholder balance, handling gray areas

Key characteristic: No "right" answer. Navigate competing values.

Example questions:

- "Should Facebook allow political ads during elections?"

- "How would you handle user data privacy vs. personalization tradeoffs?"

- "Should YouTube remove controversial but legal content?"

- "How do you balance growth with user wellbeing?"

Critical structure:

- Acknowledge the tension (don't minimize the dilemma)

- Identify stakeholders (users, advertisers, society, company)

- Analyze tradeoffs (for each stakeholder)

- Make a recommendation (with principles, not just pragmatism)

- Mitigate downsides (how to minimize harm)

Common mistake: Being too idealistic or too cynical. Balance business reality with user welfare.

Type 12: Estimation / Sizing (2% of interviews)

What it tests: Quantitative reasoning, structured thinking, business sense

Key characteristic: Fermi estimation — "How many X are there?"

Example questions:

- "How many iPhones are sold in the US per year?"

- "Estimate the number of Uber rides in San Francisco daily"

- "What's the market size for food delivery apps in India?"

- "How many searches happen on Google per day?"

Critical structure:

- State assumptions clearly (population, usage rates, etc.)

- Break down into manageable pieces (top-down + bottom-up)

- Show your math (write it out)

- Sanity check (does this number make sense?)

Common mistake: Guessing instead of structured estimation.

Type 13: Root Cause Analysis (1% of interviews)

What it tests: Debugging skills, systematic troubleshooting, technical depth

Key characteristic: Something broke. Find the root cause.

Example questions:

- "Login feature stopped working. How do you debug it?"

- "Users report the app is slow. What do you do?"

- "Push notifications aren't being delivered. Investigate why."

- "Payment processing is failing. How do you find the root cause?"

Critical structure:

- Clarify the issue (when started? which users? which platforms?)

- Hypothesize causes:

- Client-side (app bug, OS update)

- Server-side (API failure, database issue)

- Network (connectivity, CDN)

- Third-party (payment provider, auth service)

- Investigation plan (check logs, reproduce, isolate)

- Fix + prevention (immediate fix + long-term solution)

Common mistake: Jumping to solutions before isolating the root cause.

How to Practice Each Type

The mistake most candidates make: Practicing "product design" generically.

The right approach: Practice each type separately with type-specific evaluation criteria.

Practice Strategy:

Week 1-2: Master Tier 1 (Types 1-3)

- Type 1: 5 practice questions

- Type 2: 3 practice questions (with market sizing)

- Type 3: 2 practice questions (strategic thinking)

Week 3: Master Tier 2 (Types 4-6)

- Type 4: 2 build-vs-buy questions

- Type 5: 3 prioritization exercises

- Type 6: 2 metrics diagnosis questions

Week 4: Cover Tier 3 & 4 (Types 7-13)

- One practice question for each remaining type

- Focus on structure, not perfection

Use Company-Specific Practice

Each company has different preferences:

- Meta: Heavy on Type 1, Type 6 (growth/metrics focus)

- Google: Type 2, Type 5 (data-driven, prioritization)

- Amazon: Type 4, Type 5 (business judgment, tradeoffs)

- Apple: Type 1, Type 8 (design excellence, reimagining)

Try it on Zobhe: Generate company-specific answers for each type and see how the structure changes based on the company.

Key Takeaways

-

Not all "product questions" are the same. A Type 1 (Feature Design) requires a different structure than Type 2 (New Product).

-

Master Tier 1 first. 70% of interviews test Types 1-3. Get these perfect before worrying about edge cases.

-

Each type has unique evaluation criteria. Know what interviewers are scoring for each type.

-

Practice type-specific frameworks. Don't use CIRCLES for everything. Type 6 needs metrics frameworks, Type 4 needs build-vs-buy analysis.

-

Company-specific nuances matter. Meta's Type 1 answer should mention Growth Accounting. Google's should mention A/B testing and HEART metrics.

Practice Now

Ready to master all 13 types?

Try Zobhe to:

- Generate answers for each question type

- See company-specific structures (Meta ≠ Google ≠ Amazon)

- Practice with real interview questions

- Get feedback on your approach

Recommended practice order:

- Type 1: "How would you improve Instagram Stories?" (Meta)

- Type 2: "Design a product for remote workers" (Google)

- Type 6: "Facebook DAU dropped 5%. Diagnose why." (Meta)

- Type 4: "Should Netflix build, buy, or partner for gaming?" (Netflix)

Each type is evaluated differently. Each company expects different frameworks. Practice accordingly.

Want more PM interview insights? Check out:

- How to Answer Meta PM Interview Questions

- Google vs Amazon PM Interviews: What's Different? (coming soon)

- The Complete FAANG PM Interview Rubric (coming soon)

Ready to Practice?

Generate company-specific PM interview answers using Zobhe. Free forever.

Try Zobhe Now